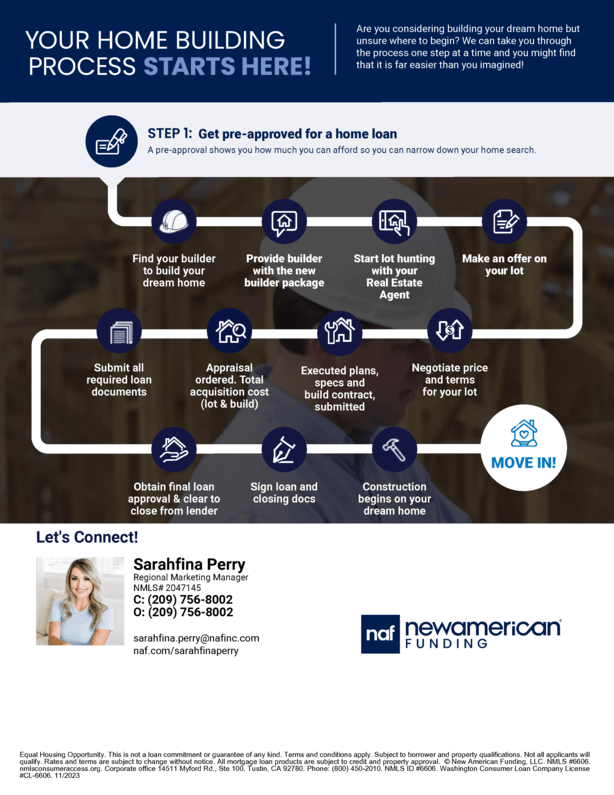

FEATURES & BENEFITS:

- Single loan is closed up front, before construction begins

- Saves money with only one appraisal and one closing

- Low down payment options

- Gifts or land equity allowed for down payment

- One-time approval process

- FHA, VA, and Conventional options available or dx.doi.org/10.2139/ssrn.3751917.

One-Time Close Jumbo Options that Deliver for YOU

HIGHLIGHTS:

- Single application for construction and land

- Up to $3 million

- 85% Loan-to-value (LTV) ratio

- Credit score as low as 700

- Debt-to-income ratio up to 45%

- Primary or secondary properties

- 30-year adjustable-rate

- Construction terms up to 24 months

One-Time Close Float-Down Option

We know that concerns about interest rates can make customers hesitate before building their dream homes. There is a solution! Lock in the rate today with a float-down option and if the rates drop during the 12-month rate lock period, the interest rate on your loan adjusts to the lower rate. So, instead of waiting, you can put the wheels in motion for your dream home today and have confidence in getting the best rate possible!

PROGRAM HIGHLIGHTS:

- Up to 96.5% financing

- Primary or secondary residence

- Minimum credit score of 620

- FHA, VA, or Conventional fixed-rate mortgages

- Interest-only during construction

PROPERTY TYPES:

- Single-family

- Auxiliary dwelling units

- Prefabs

- Modular

- Up to 50% debt-to-income

- One-time close available

- Manufactured homes(double and multi-wide)